Opening a bank account in France can seem daunting, especially for expats and newcomers. Between the different types of accounts, the paperwork, and the language barrier, it can be difficult to know where to start. However, having a bank account is essential for managing your finances in France, and it’s not as difficult as it may seem. In this article, we will explain to you how to open a bank account in France quickly, and we will show you a selection of the best banks in France.

🇪🇺 Why Having a Bank Account in France

To pay your home internet, mobile plan, electricity bill, or receive your monthly pay, you will need to have a bank account that has 🇪🇺 EU IBAN (International Bank Account Number).

⚠️ Some services may require a 🇫🇷 French IBAN though.

🛒 Ways to Pay in France

In France, we pay more and more by card. However, it is not rare to find shops, bars, or restaurants that apply a minimum amount to spend to pay by card. So, you would sometimes need to withdraw money at the ATM to pay by cash.

🏦 Which Bank to Choose

You have just decided to sign up to a bank in France. Great! I have tested many French banks and I selected for you the best banks in France with these criteria:

- 🇪🇺 EU IBAN: they have at least an EU or a French IBAN

- 🤑 Good pricing: from 0€/month

- ✍️ Easy registration: the documents needed are reduced to the minimum for the mobile banks

- 💳 Debit card or deferred debit card

- 💸 Free € wire transfer

- 👍 Great user experience

Now, you will need to answer a few questions, so I can show you a selection of the best banks based on your needs. Let’s go!

Deferred debit card: money will be withdrawn from your bank account at a defined date, every month, and free of charge. Sometimes needed to rent a car.

🇫🇷💳🛍️🧧💰💹

🇫🇷💳🛍️🧧💰💹

✍️ revolut.com only

✅ 10 min

💰 From 0€/month

🇫🇷 French IBAN

💳 Debit card

🛍️ Up to 5 virtual cards

🏧 Free ATM withdrawals (limit)

💱 Free payments worldwide (limit)

🏆 The best all-in-one money app

ℹ️ Information

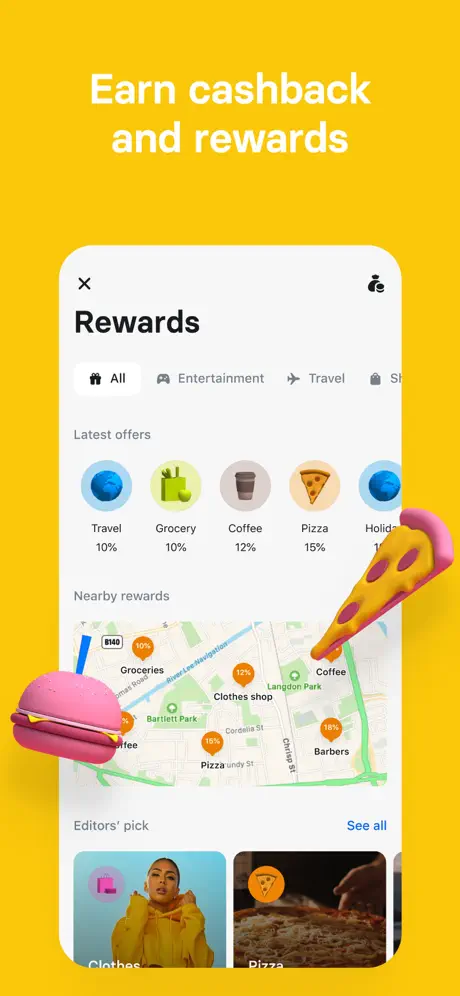

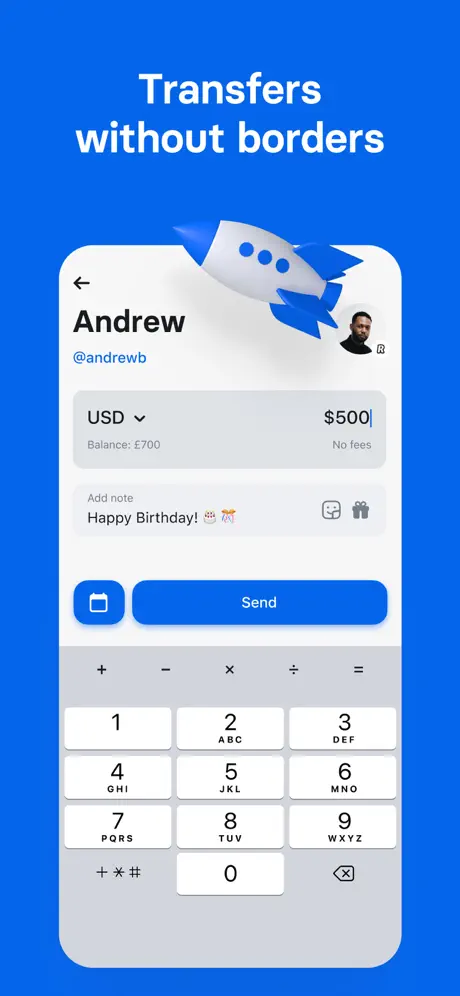

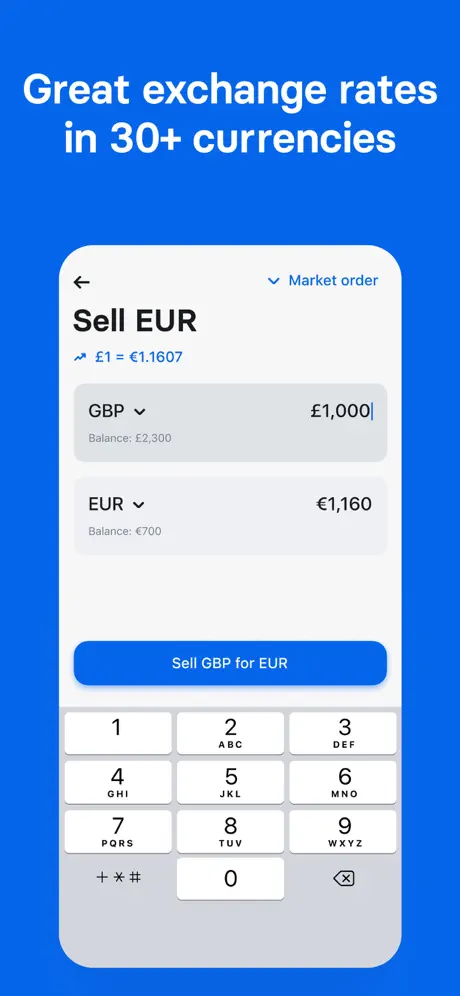

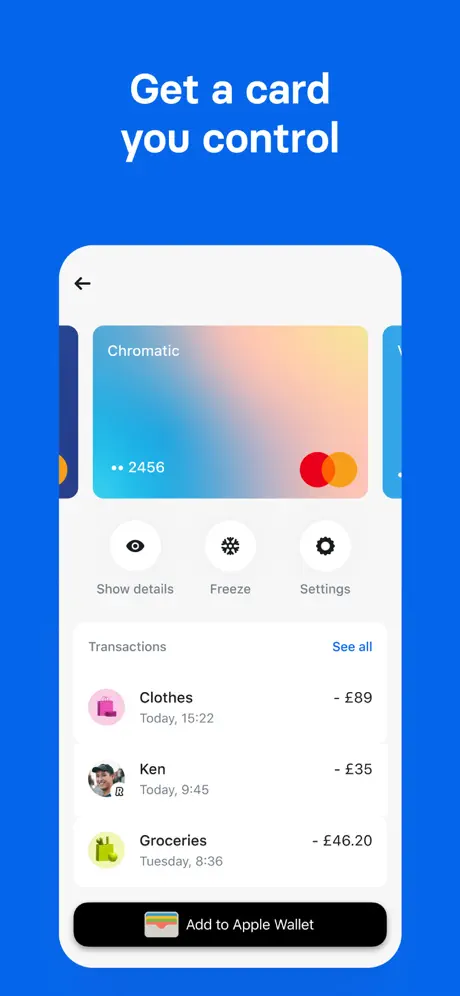

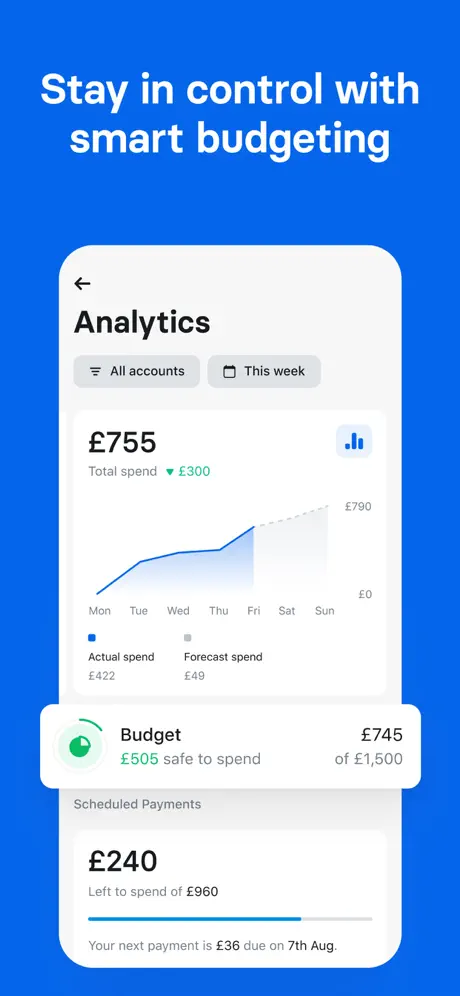

Revolut is a mobile application providing all kinds of financial services. In their free plan, they provide all you need to manage and spend your money: a debit card, free ATM withdrawals (within 200€/month), free payments worldwide (within 1,000€/month), a multi-currency account where you can hold and send 29 currencies, and a convenient way to send and receive money between friends (like Venmo in the US).

I think it is perfect for your daily life as well as when you travel. If you need more services such as a premium card or insurance (travel, car, etc), you will be able to upgrade to better plans.

💰 Price

Here are the added features for each plan:

| Standard 0€/month | 🇫🇷 French IBAN 💳 Debit card 🛍️ Up to 5 virtual cards 📲 Mobile application to manage easily your finance 📥 Add money by wire transfer/card ⚡️ Free instant € wire transfer 👫 Send/receive money with people instantly (e.g.: reimburse your friend for a restaurant) 🏧 Free ATM withdrawals (within 200€/month or 5 times) 💱 Free payments worldwide during weekdays (within 1,000€/month) 💹 Multi-currency account with 29 currencies you can hold and send 📈 Buy/sell stocks 🪙 Buy/sell crypto |

| Plus 2.99€/month | 💳 Personalized card 🏧 Free ATM withdrawals (within 200€/month) |

| Premium 7.99€/month | 💳 Premium card 🏧 Free ATM withdrawals (within 400€/month) 💱 No foreign transaction fees (unlimited payments) 💸 20% discount on international wire transfer fees 🧳 Travel insurance included |

| Metal 13.99€/month | 💳 Metal card 🏧 Free ATM withdrawals (within 800€/month) 💸 40% discount on international wire transfer fees |

| Ultra 45€/month | 💳 Platine card 🏧 Free ATM withdrawals (within 2,000€/month) 💸 Free international wire transfer fees ✈️ Unlimited access to airport lounges |

🛟 Customer Support

You can reach a customer agent:

- 📲 mobile application

- 📞 phone (with Ultra plan)

✍️ How to Register

📂 What you need to have:

- 🏠 Be a legal resident of 🇪🇺/🇬🇧/🇨🇭/🇦🇺/🇳🇿/🇸🇬/🇯🇵/🇺🇸/🇧🇷/etc (the list can be found here).

- 🪪 ID Document (passport, ID card, or residence permit)

You can register:

- 🌐 online

Your account can be validated in 10 minutes.

⚠️ If you register from your country, you might have the local IBAN instead of a French IBAN.

⚠️ If you register from the United States, you might not have an 🇪🇺 EU IBAN, because you might be registered to Revolut US which is a different version of their international product.

🌐 Website

💳🛍️🧧💹🏳️

💳🛍️🧧💹🏳️

✍️ wise.com only

✅ 10 min

💰 0€/month

🇧🇪 BE IBAN

🏳️ 10 local accounts (🇺🇸/🇨🇦/etc)

💳 Debit card (7€)

🛍️ Up to 3 virtual cards

🏧 Free € ATM withdrawals (limit)

💸 Send money abroad for cheap

💡 Easy to register from 🇺🇸/🇧🇷

ℹ️ Information

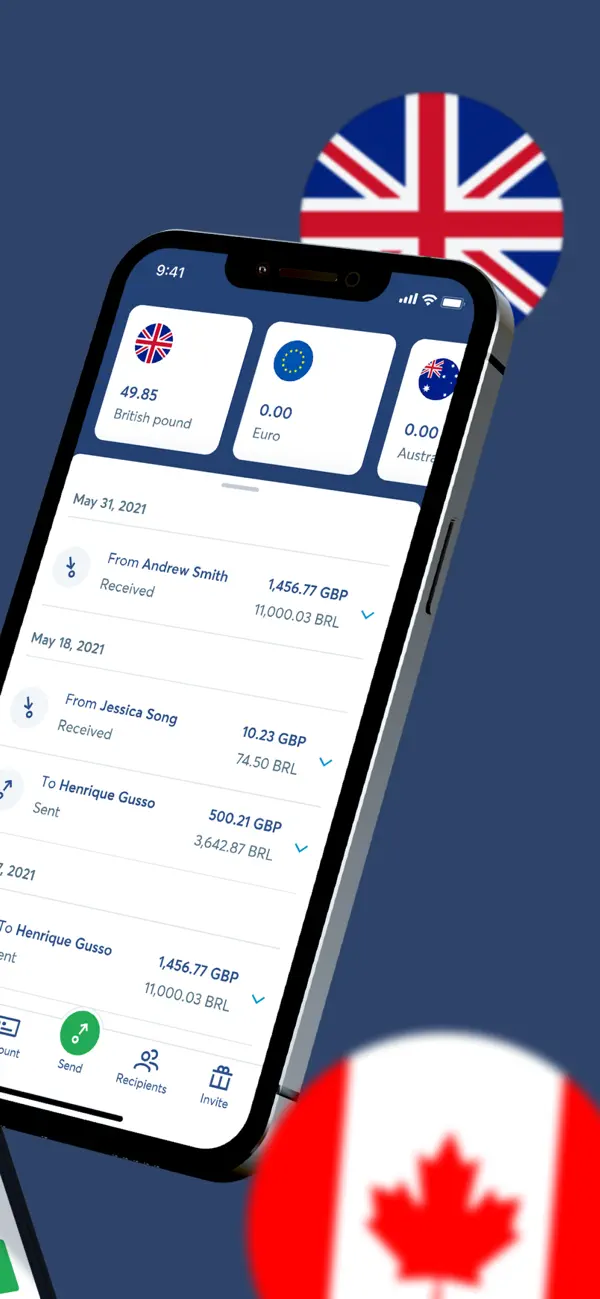

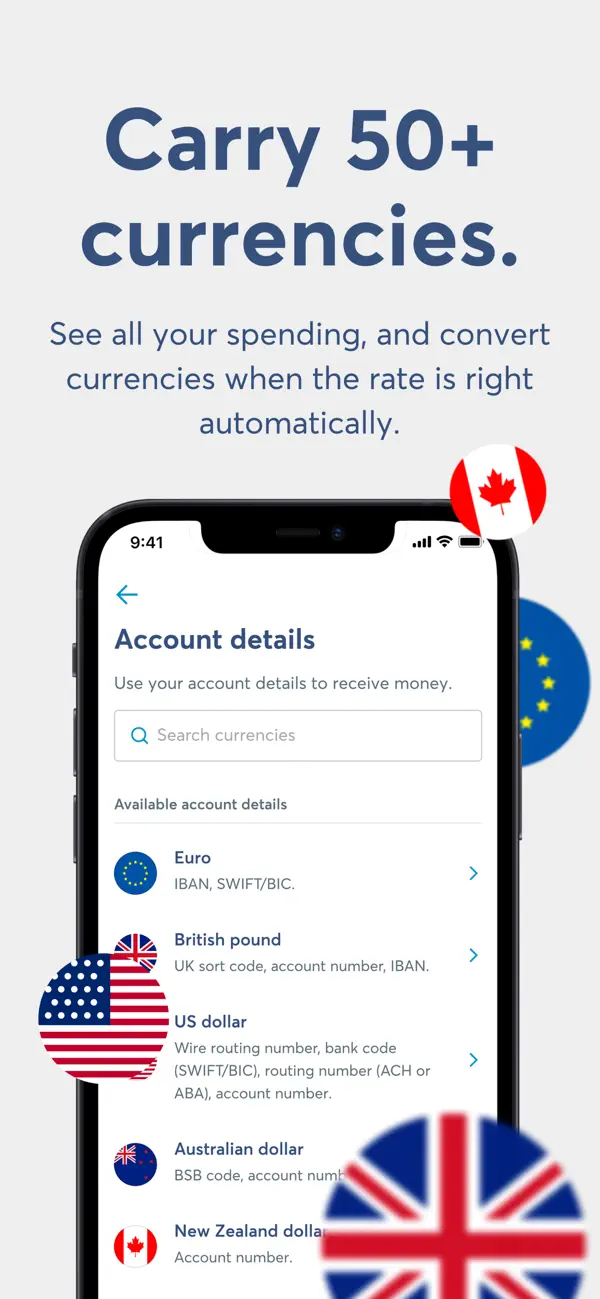

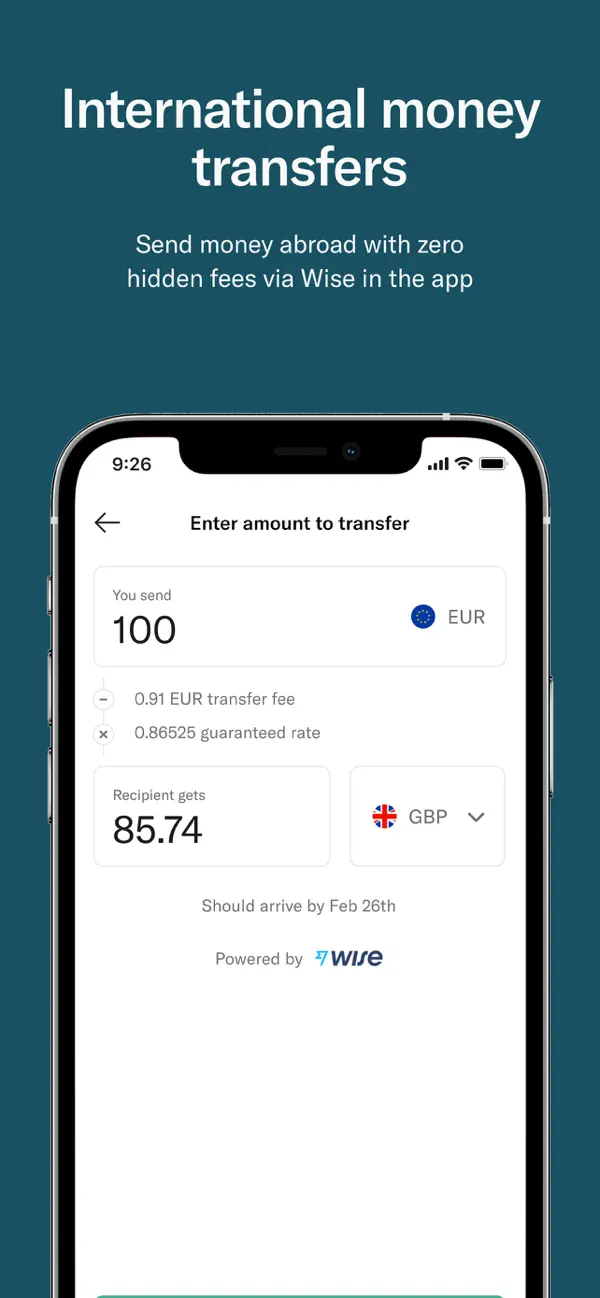

Wise is an online bank where you can have access for free, to 10 local bank accounts: 🇪🇺 EUR (from 🇧🇪 Belgium), 🇺🇸 USD, 🇨🇦 CAD, 🇬🇧 GBP, 🇦🇺 AUD, 🇳🇿 GBP, 🇸🇬 SGD, 🇹🇷 TRY, 🇭🇺 HUF, 🇷🇴 RON. Moreover, you will have access to a multi-currency account where you can hold and send 40 currencies. You will also be able to get a debit card, up to 3 virtual cards, free € ATM withdrawals (3 times/month), and cheap fees on international wire transfers.

I think it is the perfect bank if you need to make a lot of international wire transfers.

💡 For 🇺🇸/🇧🇷 citizens: it might be a good idea to open a Wise bank account in your home country before coming to France, to make the start of your stay in France easier, as you might have issues opening a bank account in some banks.

💰 Price

| 0€/month | 🇧🇪 Belgium IBAN 🏳️ 10 local account details (🇧🇪/🇺🇸/🇨🇦/🇬🇧/🇦🇺/🇳🇿/🇸🇬/🇹🇷/🇭🇺/🇷🇴) 💳 Debit card (7€ shipping fee) 🛍️ Up to 3 virtual cards 📲 Mobile application to manage easily your finance 📥 Add money by wire transfer/card ⚡️ Free instant € wire transfer 🏧 Free € ATM withdrawals (within 200€/month or 3 times/month) 💱 Fees on payments worldwide 💹 Multi-currency account with 40 currencies you can hold and send 💸 Cheap fees on international wire transfers |

🛟 Customer Support

You can reach a customer agent:

- 📲 mobile application

✍️ How to Register

📂 What you need to have:

- 🏠 Be a legal resident of 🇪🇺/🇬🇧/🇨🇭/🇺🇸/🇨🇦/🇦🇺/🇳🇿/🇸🇬/🇲🇾/🇯🇵/🇧🇷 (the list can be found here)

- 🪪 ID Document (passport, ID card, or residence permit)

- 📍 Proof of address (ex: utility bills, bank or credit card statement, council tax bill, etc)

You can register:

- 🌐 online

Your account can be validated in 10 minutes.

🌐 Website

🇫🇷💳🛍️

🇫🇷💳🛍️

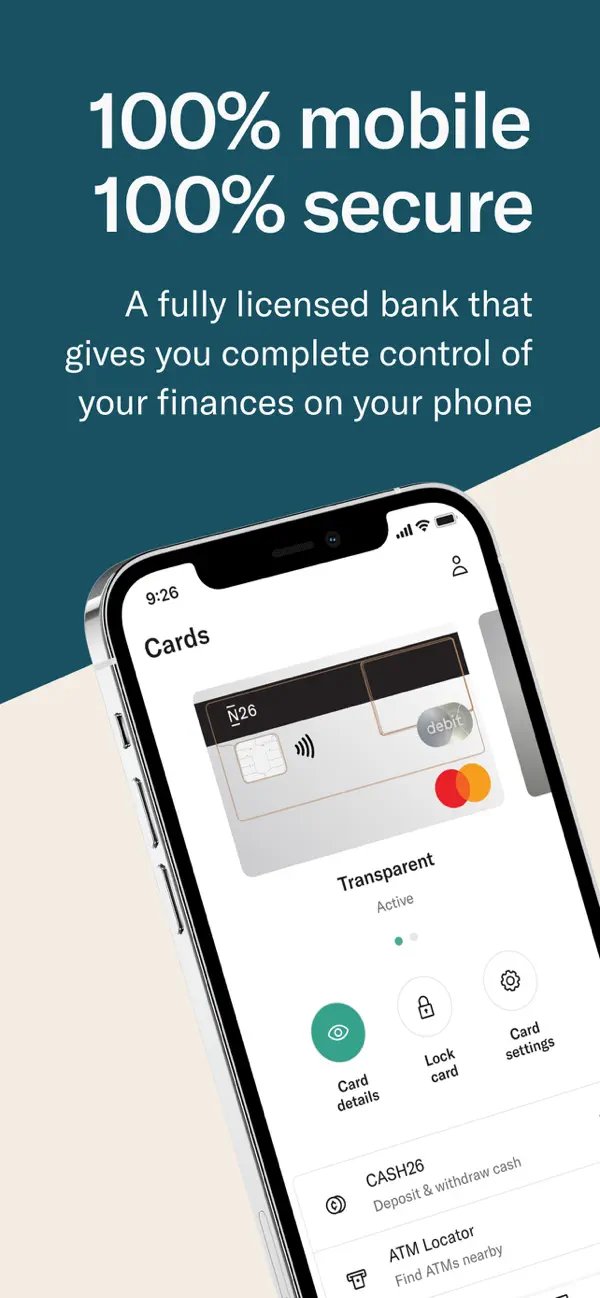

✍️ n26.com only

✅ 10 min

💰 From 0€/month

🇫🇷 French IBAN

💳 Debit card (10€)

🛍️ Up to 1 virtual card

🏧 Free € ATM withdrawals (limit)

💱 Free payments worldwide

🌍 Cheap bank to pay worldwide

ℹ️ Information

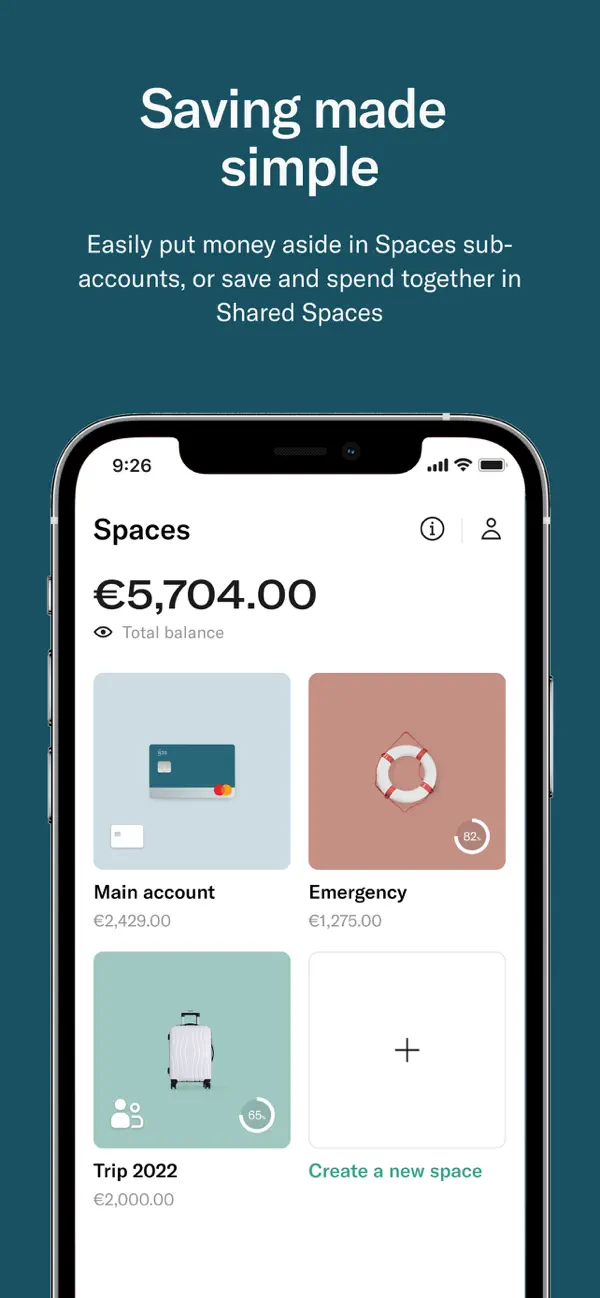

N26 is a mobile bank providing all kinds of services around banking: a 🇫🇷 French IBAN, a virtual card, a debit card, free € ATM withdrawals (3 times/month), free payments worldwide (unlimited)

I think it is the perfect bank for daily payments or if you pay a lot abroad.

💰 Price

Here are the added features for each plan:

| N26 Standard 0€/month | 🇫🇷 French IBAN 💳 Debit card (10€ shipping fee) 🛍️ Up to 1 virtual card 📲 Mobile application to manage easily your finance 📥 Add money by wire transfer/card 🏧 Free € ATM withdrawals (3 times/month) 💱 Free payments worldwide (unlimited) 💸 International wire transfer with Wise |

| N26 Smart 4.90€/month | 💳 Debit card (No shipping fee) ⚡️ Free instant € wire transfer 🏧 More free € ATM withdrawals (5 times/month) 🛟 Phone support |

| N26 You 9.90€/month | 🏧 Free ATM withdrawals abroad 🧳 Travel insurance included |

| N26 Metal 16.90€/month | 💳 Metal card 🏧 More free € ATM withdrawals (8 times/month) 📱 Mobile phone insurance |

🛟 Customer Support

You can reach a customer agent:

- 📲 mobile application

- 📞 phone (with paid plans)

✍️ How to Register

📂 What you need to have:

- 🏠 Be a legal resident of 🇪🇺/🇨🇭 (the list can be found here).

- 🪪 ID Document (passport, ID card, or residence permit)

You can register:

- 🌐 online

Your account can be validated in 10 minutes.

⚠️ If you register from your country, you might have the local IBAN instead of a French IBAN.

🌐 Website

🇫🇷💳🧧🔻💰🏠

🇫🇷💳🧧🔻💰🏠

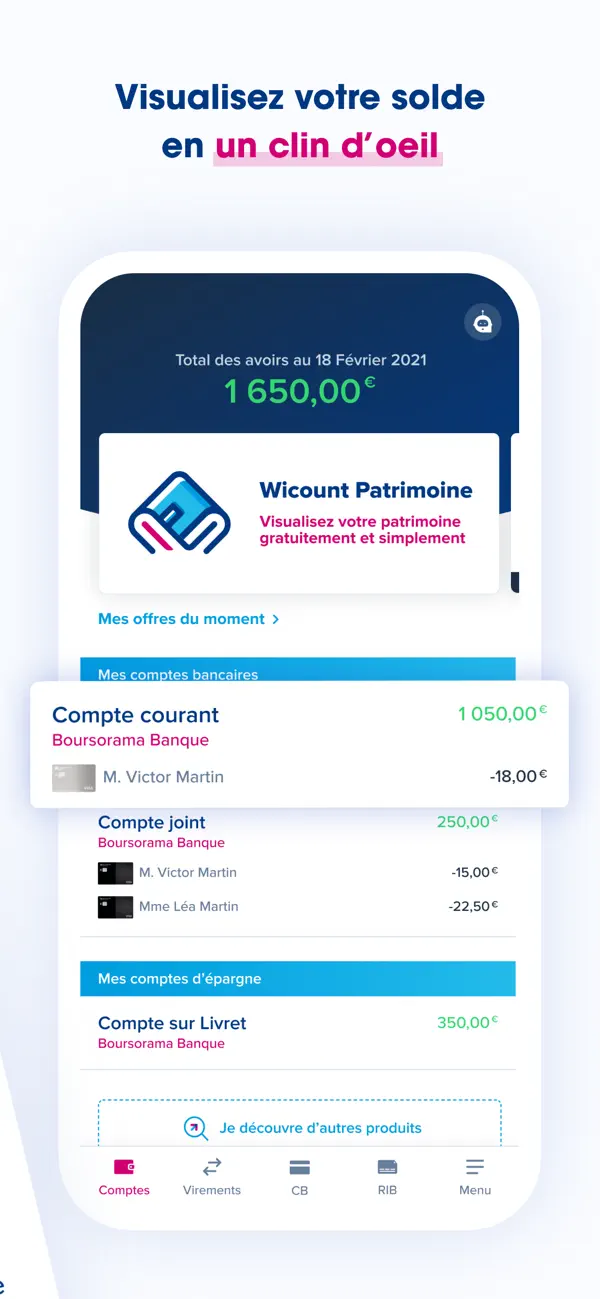

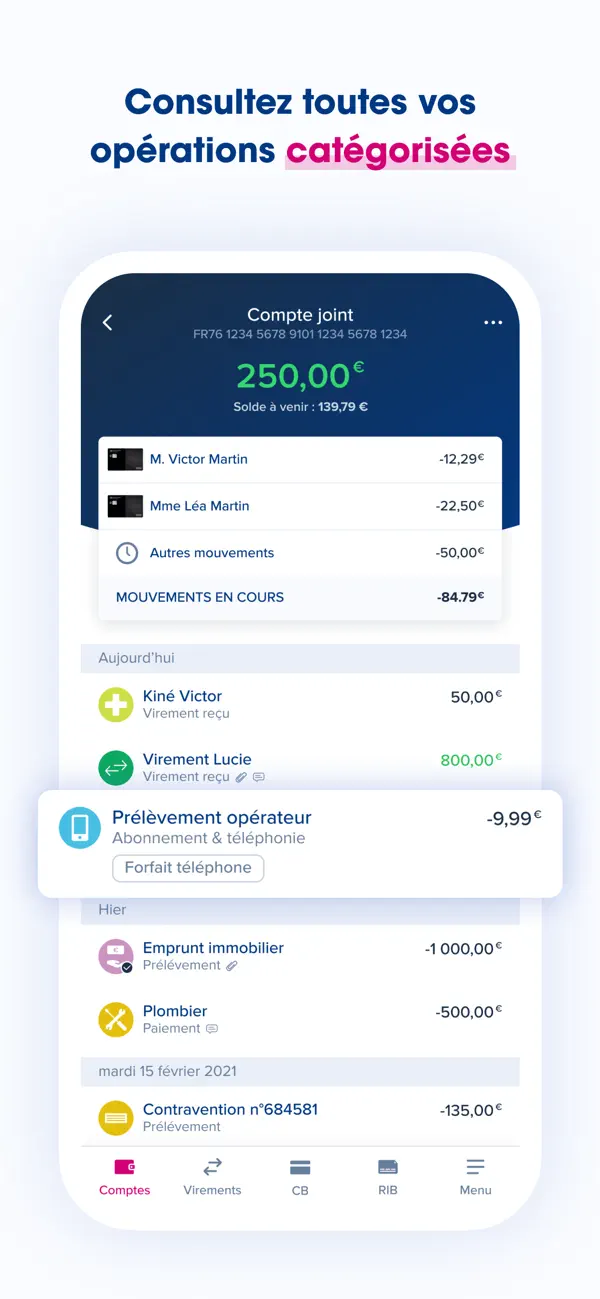

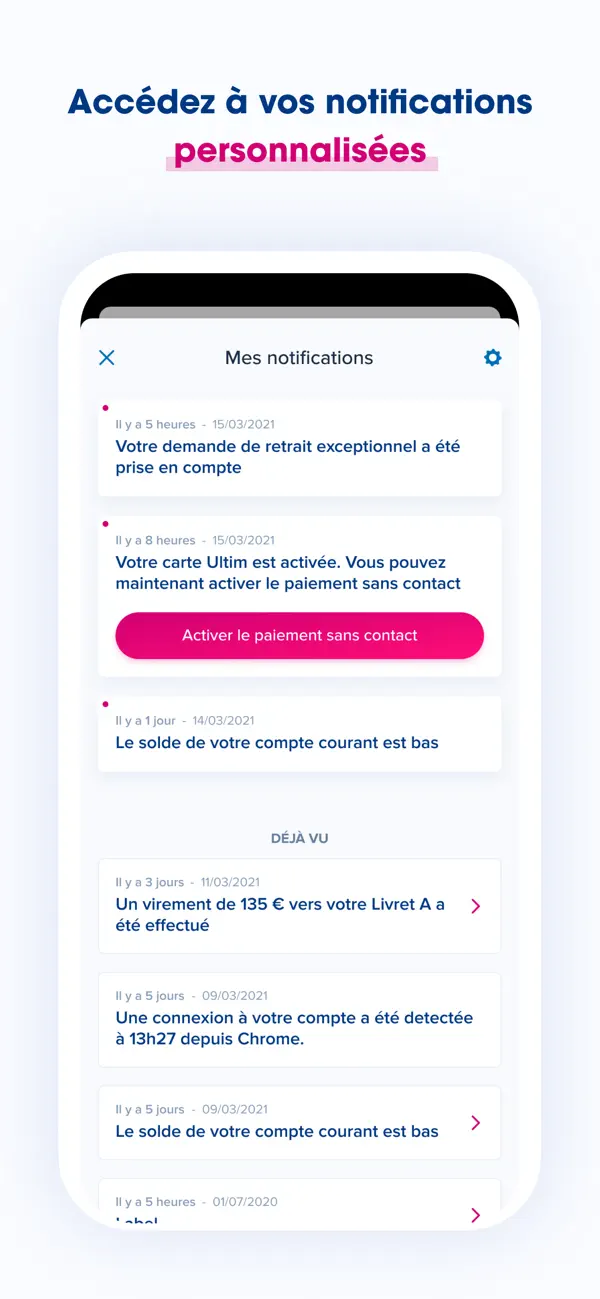

✍️ boursorama-banque.com only

✅ Few days

💰 From 0€/month

🇫🇷 French IBAN

💳 Premium debit/deferred debit card

🏧 Free ATM withdrawals (limit)

💱 Free payments worldwide

🔻 Up to 2,500€ bank overdraft

🧳 Travel insurance included

💪 Bank with a free premium card

ℹ️ Information

Boursorama Banque is a French online bank backed by SG Société Générale which is one of the main banks in France.

The main advantage of opening a bank account with Boursorama Banque is to have a premium card with travel insurance included. Moreover, there are free payments worldwide and free ATM withdrawals with this bank.

💰 Price

Here are the added features for each plan:

| ULTIM 0€/month ⚠️ 1 payment/month required, otherwise 9€/month | 🇫🇷 French IBAN 💳 Premium debit/deferred debit card ⚠️ If you choose the deferred debit card: a 2,400€/month salary is required for the subscription 📲 Mobile application to manage easily your finance 📥 Add money by wire transfer ⚡️ Free instant € wire transfer 🏧 Free ATM withdrawals (unlimited in €, 3 times/month abroad) 💱 Free payments worldwide 🔻 Up to 2,500€ bank overdraft after 3 months 🧳 Travel insurance included |

| METAL 9.90€/month | 💳 Metal debit/deferred debit card ⚠️ If you choose the deferred debit card: a 6,250€/month salary is required for the subscription 🏧 Free ATM withdrawals (unlimited in € and abroad) 🔻 Up to 10,000€ bank overdraft after 3 months |

💡 Car rental companies require sometimes to be paid with a deferred debit card.

🛟 Customer Support

You can reach a customer agent:

- 📲 mobile application

✍️ How to Register

📂 What you need to have:

- 🪪 ID Document (passport, ID card, or residence permit): photocopy

- 📍 Proof of address (ex: utility bills, bank or credit card statement, council tax bill, etc): photocopy

- 🇫🇷 French IBAN: photocopy with your first name and last name

- 🧾 Last 2 salary slips, last tax notice, proof of pension or school certificate

- ✍️ Your signature on a white sheet of paper

You can register:

- 🌐 online

Your account can be validated in a few days.

🌐 Website

🇫🇷💳🧧🏦🔻💰🏠

🇫🇷💳🧧🏦🔻💰🏠

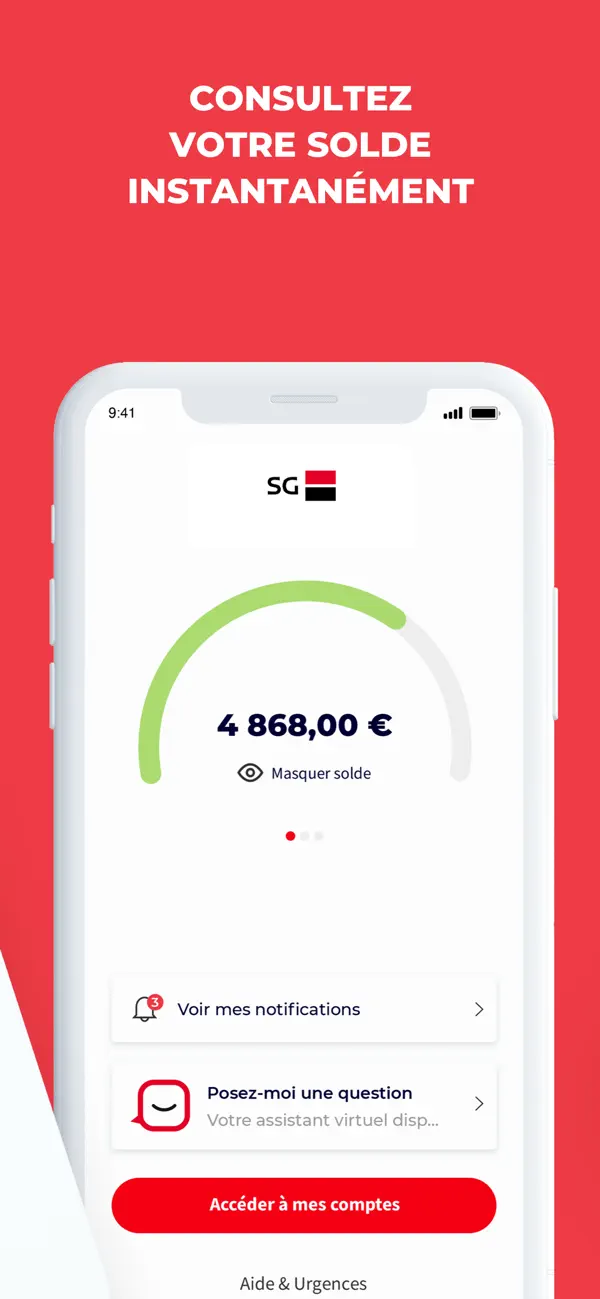

✍️ sg.fr, SG bank branches

✅ Few days

💰 From 3€/month

🇫🇷 French IBAN

💳 Debit/deferred debit card

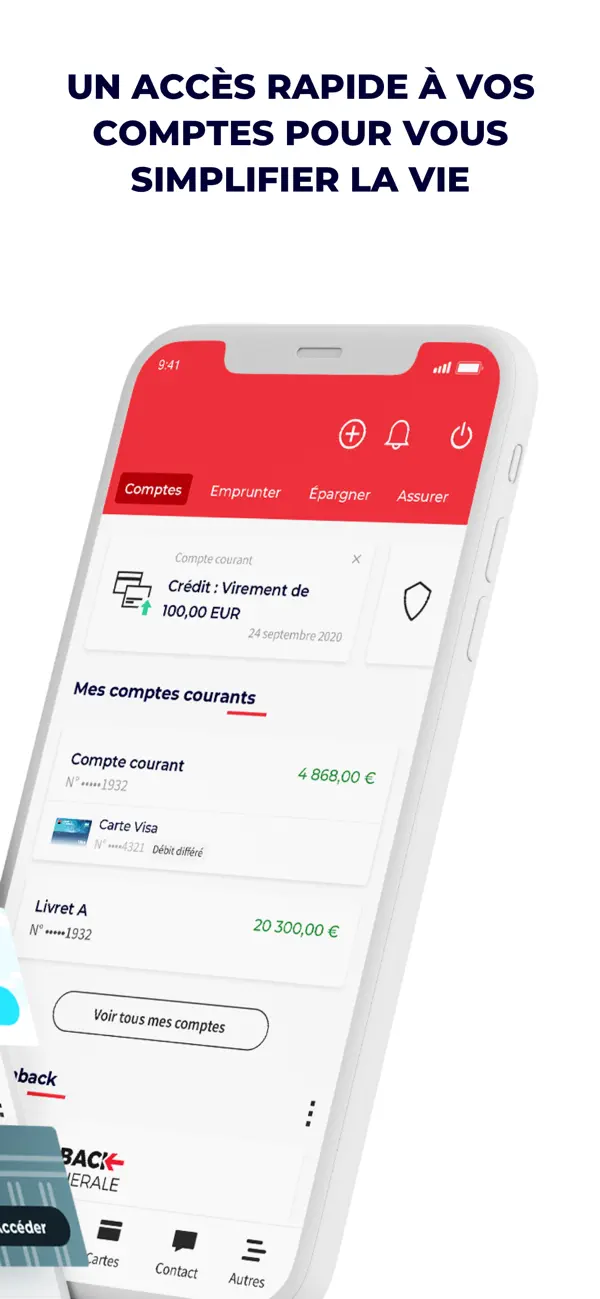

📲 Traditional bank with the best app

ℹ️ Information

SG (Société Générale) is one of the main French banks, with many branches all over the country. They have the best app of all the main French traditional banks. However, all the traditional banks in France are more expensive than the online/mobile banks shown previously in the list.

I would recommend this bank if you need to:

- open a bank account but you couldn’t with all the banks shown previously

- have access to bank branches

- get a mortgage for your apartment/house

💰 Price

Here are the added features for each plan:

| Visa Evolution 🎓 3€/month 👨💼 5.75€/month 👴 7.20€/month | 🇫🇷 French IBAN 💳 Premium debit/deferred debit card 📲 Mobile application to manage easily your finance 📥 Add money by wire transfer 🏧 Paid € ATM withdrawals outside SG branches (1€/withdrawal) |

| Visa Classique 🎓 3€/month 👨💼 6.32€/month 👴 7.90€/month | 🏧 Free € ATM withdrawals (3 times/month outside SG branches) 🧳 Travel insurance included |

| Visa Premier 🎓 13€/month 👨💼 14.90€/month 👴 14.90€/month | 🏧 Free € ATM withdrawals (unlimited) 🧳 Travel insurance with luggage lost included |

🛟 Customer Support

You can reach a customer agent:

- 📲 mobile application

- 📞 phone

✍️ How to Register

📂 What you need to have:

- 🪪 ID Document (passport, ID card, or residence permit): photocopy

- 📍 Proof of address (ex: utility bills, bank or credit card statement, council tax bill, etc): photocopy

You can register:

Your account can be validated in a few days.

💡 If you are a student, your school might have a partnership with SG to offer a discounted plan with a debit card.

Conclusion

To summarize:

(revolut.com) is my number 🥇 recommendation. It has the best user experience, and a lot of perks included such as a French IBAN, a free debit card, an instant wire transfer, and no currency exchange fees.

(revolut.com) is my number 🥇 recommendation. It has the best user experience, and a lot of perks included such as a French IBAN, a free debit card, an instant wire transfer, and no currency exchange fees.- If you are from the 🇺🇸 US or 🇧🇷 Brazil,

(wise.com) can be opened from your home country, so you won’t need to rush to open a bank account when you come to France. It is also a great tool if you make a lot of wire transfers in different currencies.

(wise.com) can be opened from your home country, so you won’t need to rush to open a bank account when you come to France. It is also a great tool if you make a lot of wire transfers in different currencies.

Now, you know which bank to register to. Hope you will have an easy registration!

5 replies on “🏦 The Best Banks in France: Open an Account in 10 Minutes”

Merci

Hope it helped 🫶

Any of these banks accepted as French Bank account when we transfer funds for purchasing a property in France?

Hello Jinny,

Yes, except Wise.

I don’t know if you plan paying by cash or having a mortgage, but if you plan to have a mortgage with a French bank, it will be mandatory to have a bank account with them, as they will open a new bank account to get the fund back every month.

If you just pay by cash, and the notary said that it is mandatory to have a French bank account, you would better have a bank which can help you transfer huge amount of money, as the banks I show are mostly online banks.

Tell me if you have any questions.

Both my partner and myself purchased properties (2018, 2021 and 2023) in France and used Wise to pay the full amounts. There were checks, by Wise, to see where the money was coming from. Other than that it was hassle free.